Press Releases

Homeowners urged to get flood insurance

ROSEBURG, Ore. – The Roseburg Community Development Department and the Federal Emergency Management Agency encourage homeowners and other building owners – especially those with properties in or near flood zones -- to carry sufficient flood insurance and take other steps to protect their properties this spring.

In addition, property owners with flood damage should contact the Roseburg Community Development Department and/or Douglas County Building Department for permitting information involving structural changes needed for repairs.

In light of flooding that occurred Sunday, March 16, when the South Umpqua River and Newton and Deer creeks overflowed as Roseburg experienced record rainfall of 3.47 inches on a single day, the Community Development Department encourages even homeowners and people owning buildings that aren’t in the floodplain to consider getting flood insurance to protect their investments and support community-wide recovery in the event of more flooding.

“The flooding and stormwater impacts took many of us in Roseburg by surprise. Unfortunately, only about one in nine floodplain property owners inside city limits carry flood insurance,” said City Floodplain Administrator Mark Moffett.

“With the last major floods occurring in 1997 and 1964, it would appear we get a flooding event every 30 years or so,” he added. “But Mother Nature is unpredictable and we can never really be sure when the next event will happen. To reduce the risk of loss to life or property during flooding events, flood insurance could be a wise investment.”

Homes and other buildings located in a Special Floodplain Hazard Area are designated as “high risk” to experience flooding, and such buildings that also have current government-backed mortgages are required by their lenders to buy flood insurance, which is not covered by most homeowners’ or non-residential building insurance.

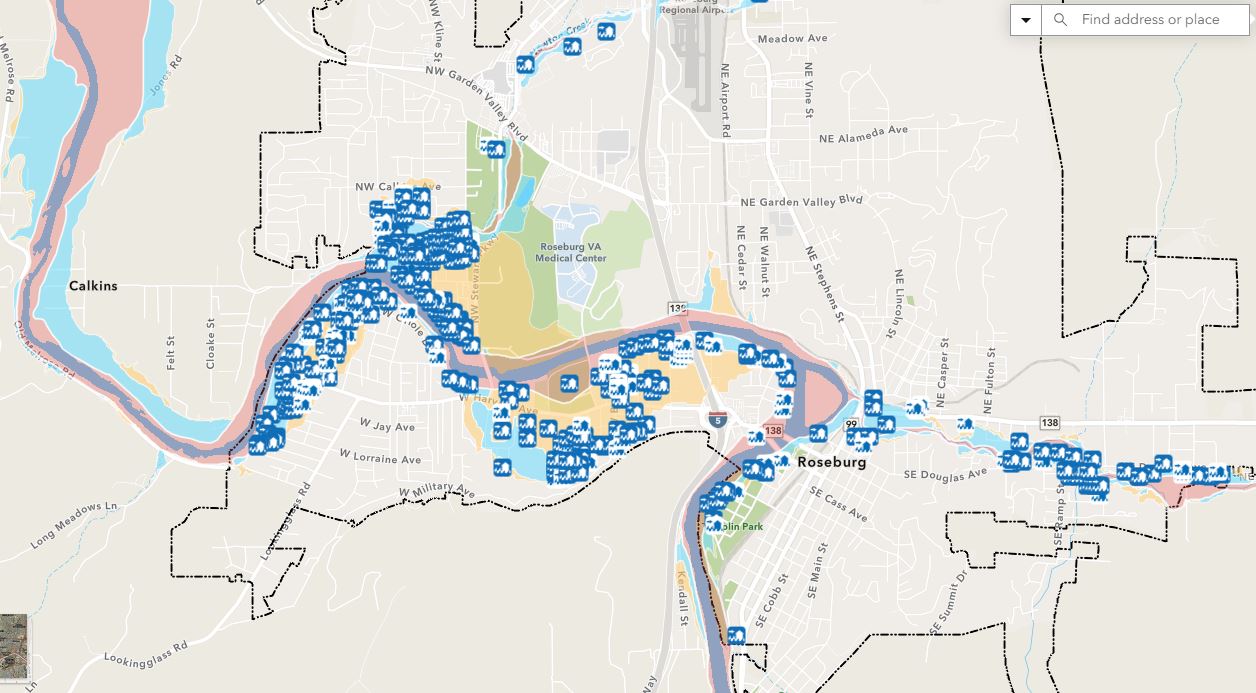

Flood insurance usually requires a 30-day waiting period before taking effect. Property owners, homebuyers, renters, realtors and insurance agents can quickly determine where their building lies in relation to flood zones and search for other floodplain information or documents needed to get flood insurance by using the Community Development Department’s interactive Floodplain Information Map.

While floods don’t happen very often, Roseburg residents have just experienced the potential damage that can result in such an emergency. That’s why flood insurance is a critical component in protecting people’s homes and towns.

Roseburg has many hills and slopes, so large amounts of groundwater can gather during a big rain event and flood homes that aren’t even located in the floodplain near creeks or rivers. Flooding can occur in any location where rain or snow falls – not just in high-risk flood areas, according to FEMA’s floodsmart.gov.

About 40% of flood insurance claims under the National Flood Insurance Program involve properties with low to moderate risk. Unusual and rapid accumulation, or runoff from surface waters, can make properties vulnerable to flooding. Renters living on a ground floor should note renters’ insurance doesn’t typically cover flooding, reports FEMA.

“Anybody can apply for, and get, flood insurance. You don’t have to live in a floodplain,” said Roseburg Community Development Department Director Stuart Cowie.

Currently, 1,405 buildings -- including single- and multi-family homes, as well as non-residential commercial, industrial, government/institutional and even public park space -- are considered high risk because they’re located in Roseburg’s Special Floodplain Hazard Area along the South Umpqua River, Deer Creek or Newton Creek. However, only 173 of those buildings – or 12.3% -- are protected with flood insurance, said Moffett.

Additional properties sit close enough to the floodplain area to be considered “moderate risk” for flooding every 100 to 500 years. Community Development Department staff have spoken directly to several property owners in or near high-risk flood zones to encourage them to buy flood insurance that will help minimize risk and loss during possible flooding.

Property owners wanting flood insurance should obtain an Elevation Certificate from a licensed surveyor and then contact their insurance company. Community Development staff can provide residents with a list of local surveyors.

Property owners can save money on flood insurance if Roseburg remains in good standing with FEMA’s flood insurance program through construction practices and enough property owners carrying flood insurance.

“Helping private developers build to current FEMA floodplain standards keeps the City of Roseburg in good standing with the National Flood Insurance Program. Being in good standing with the program can help to create a lower floodplain insurance premium for all those residents who purchase flood insurance,” Cowie said.

Property owners inside city limits can benefit from a 15% discount off standard, full-risk National Flood Insurance Program policies because the City works hard to maintain Roseburg’s Class 7 rating and is among only 19 Oregon cities that qualify under FEMA’s Community Rating System. Communities earn city-wide discounts through such activities as public information campaigns, mapping, regulations, flood-damage reduction, warning and response.

Wildfires and drought increase flood risks, and one inch of floodwater could cause $25,000 in damage, according to FEMA. Remember, disaster assistance may be limited or unavailable if flooding occurs. While federal disaster assistance is only available if the president declares a disaster, flood insurance protects homes even if a disaster is not declared.

Moffett, who’s also a senior City planner, said property owners with flood damage who want to undertake work along rivers or creek banks should discuss such projects in advance with the U.S. Army Corps of Engineers before any changes are made along or in local waterways.

He also encouraged property owners to contact the City’s Community Development Department at 541-492-6750 and/or the Douglas County Building Department at 541-440-4559 for permitting information if structural changes are needed for repairs. Clean up and simple repairs such as replacing sheetrock should not require permits, but changing framing or other structural features likely will, he added.

“We are here to help and will do what we can to make the process as simple as possible,” Moffett said.

FEMA and the City recommend people with homes or businesses in or near flood zones take the following action BEFORE a flood occurs:

• Take steps to protect your home or business, family and financial security throughout the year;

• Take extra precautions when flooding is predicted in Roseburg;

• The best way to protect your home, business and belongings from flood damage is to buy flood insurance beforehand;

• Know your flood risk: Check out the City’s interactive Floodplain Information Map or use FEMA’s online Flood Map Service Center;

• Schedule an “insurance check-up” with your insurance agent to make sure you have the right coverage and amounts;

• Store documents in a safe, dry place: Keep original birth certificates, passports, medical records and insurance papers in a watertight safety deposit box. Keep copies in a safe, dry place.

• Take a household/business inventory: Take photos and videos of all your major household items and valuables. Keep photo/video copies in a safe place so you can use them if you need to fill out an insurance claim;

• Minimize potential flood losses by elevating and anchoring utilities, clearing gutter debris and waterproofing your basement;

• When flooding is predicted, move furniture and valuables to a safe place, such as an attic or the highest floor;

• When flooding is imminent, your first priority should be the physical safety of you, loved ones or employees, and pets; • Stay alert by monitoring local news and weather reports and sign up for local emergency alerts;

• Create a communication plan to use with family, friends or employees during a power outage;

• National Flood Insurance policyholders are eligible for up to $1,000 to buy loss-avoidance supplies such as tarps, sandbags and water pumps when flooding is imminent or predicted. Labor, moving and storage expenses also are covered.

Learn more: floodsmart.gov/first-prepare-flooding

For questions about development or residential/commercial improvements within the floodplain, contact the Roseburg Community Development Department at 541-492-6750 or cdd@roseburgor.gov.

For questions about getting flood insurance or existing insurance policies, contact your insurance provider.

Posted by RoseburgAdmin